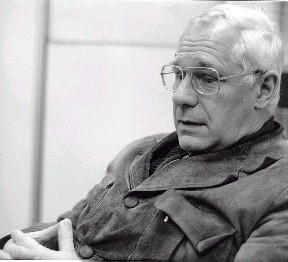

Crisis mundial: última lección de A. Gunder Frank, antes de morir

Andre Gunder Frank's predictions, made in 2004, about the world economic crisis, 2008

In one of his last major essays Frank argued prophetically about the looming global economic crisis of 2008:

Since Asia and especially China was economically powerful in the world until relatively recently, and new scholarship dates the decline as really beginning only in the second half of the nineteenth century, it was quite possible for Frank that it may soon be so again. Contrary to the Western mythology of the past century, Asian dominance in the world has so far been interrupted by an only relatively short period of only a century or at most a century and a half. The oft alleged half-century or more decline of China is purely mythological.

Chinese and other Asian economic success in the past was not based on Western ways; and much recent Asian economic success was not based on the Western model. Therefore, there is also no good reason why Japanese or other Asians – or for that matter the Arabs - need or should copy any Western or other model. Asians can manage their own ways and have no good reason to now replace them by Western ones as the alleged only way to get out of the present economic crisis. On the contrary, Asian reliance on other ways is strength and not a weakness.

The fact that the present world economic crisis visibly spread from the financial sector to the productive one does not mean that the latter is fundamentally weak. On the contrary, the present crisis of overproduction and excess capacity is evidence of the underlying strength of the productive sector, which can recover. Indeed, according to Frank, it was excess capacity and productivity leading to over-production for the world market that initiated the financial crisis of 1997/1998 to begin with when Asian foreign exchange earnings on commercial account were no longer able to finance its service of the speculative short run debt.

Not that economic recession will or can be prevented in the future. They never have been prevented in the past even under state planning in China or the Soviet Union. More significant for Frank is that this is the first time in over a century that a world recession started not in the West and then moved eastward, but that instead it started in the East and then moved around the world from there. And that was precisely because East Asian and particularly Japanese, Korean and then Chinese productive and export capacity had grown so MUCH. This recession can therefore be read as evidence not so much of the temporary weakness as of the growing basic economic strength of East Asia to which the center of gravity of the world economy is now shifting back to where it had been before the Rise of the West.

The recession in the productive sector was short, especially in Korea, and so far absent in China. But it was also severe, especially in Indonesia. And the shock-waves from the financial sector to the productive, consumer and political ones were visibly - and to all but the totally blind, intentionally - exacerbated by the economic shock policies imposed on Asian governments by the IMF as usual following the dictates of the U. S. Treasury, which systematically represents American financial interests at the expense of popular ones elsewhere around the world.

Equally significant for Frank is that India and to recently to a lesser extent China have remained substantially immune from the present recession, thanks in part to the inconvertibility of their remin ribao and rupee currencies and the valve in their capital markets that permits the inflow but controls the outflow of capital. The currency devaluations of China’s competitors elsewhere in East Asia and the reduced inflow into China of Overseas Chinese and Japanese capital that is negatively affected by the recession in East Asia may oblige China to devalue again as well to remain competitive. Nonetheless and despite their serious economic problems, the Chinese and Japanese economies appear already to have and to continue to be able to become sufficiently productively and competitively strong to resist and overcome these problems. In Southeast Asia, Malaysia has successfully followed the Chinese model of opening its capital market to inflows but restricting especially speculative capital outflows from the same. Korea did not need such emergency measures, since it had received relatively little foreign capital to begin with.

That analysis also has consequences for the perspectives of the dominant center, the United States. According to Frank, the US may [should? must??] now attempt a repeat performance of the 1980s to spend itself and its allies [now minus Japan but plus Russia?] out of the present and much deeper world recession and threatening globe-encompassing depression. The US would then again have to resort to massive Keynesian deficit [using September 11 as a pretext for probably military] RE-flationary spending as the locomotive to pull the rest of the world out of its economic doldrums. However, the US is already the world consumer of last resort, but it can be so with the savings, investments and cheap imports from abroad, which themselves form part of the global economic problem.

Moreover, to settle its now enormous and ever growing foreign debt, the US may chose also to resort to IN-flationary reduction of the burden to itself of that debt and its also ever growing foreign debt service. But even the latter could NOT avoid generating a further SUPER trade balance particularly if market demand falls further and pressure increases abroad to export to the US demand/er of last resort. But this time, there will be NO capital inflows from abroad to rescue the US economy. On the contrary, the now downward pressure to devalue the US dollar against other currencies would spark a capital flight from the US, both from US Government bonds and from Wall Street where significant stock price declines generate further price declines and deflation in world terms even if the US attempts domestic inflation.

In this context, Frank says, there is an even more immediate urgent need for the US to control Iraqi oil reserves, the second largest in the region and the most under-drilled with a large capacity to increase oil production and drive down prices. But that is not all or even the heart of the matter. Many people were surprised when President Bush added Iran and North Korea to his axis of evil. " Though they may not be so surprised at American efforts to promote a coup and change of regime in Venezuela, which supplies about 15 percent of US imports. So what do these countries have in common, many people, including Andre Gunder Frank, ask. Well, three of them have oil, but not North Korea. So what is its threat that puts it in Bush's axis? Surely not geography or alliances [Iraq and Iran were mortal enemies, and North Korea does not play ball in their league]. The answer is simple and resolves not only that puzzle but also what could otherwise appear as a rather confused and confusing US foreign policy:

[1] Iraq changed the pricing of its oil from dollars to Euros in 2000. [2] Iran threatens to do so. [3] North Korea has changed to deal only in Euros. [4] Venezuela has withdrawn some of its oil from dollar pricing and is instead swapping it for goods with other third world countries.

Nothing else, no amount of terrorism, could be more threatening to the US; for any and all of that would pull all support out from under the dollar as oil importers would no longer buy dollars but instead Euros to buy their oil. Indeed they would want also to switch their reserves out of the dollar and into the Euro. Iraq before the recent war gained about 15 percent with its switch as the Euro rose against the dollar. And besides, the Arab oil states who now sell their oil for paper dollars would be unlikely to continue turning around and spending them again for US military hardware. It is, Frank says, this horrific scenario (horrific for the present US administration) that the US occupation of Iraq is designed to prevent, with Iran next in line. Curiously, the US government or media never mentions this oil-dollar-euro detail. No wonder that major European states are opposed to Bush's Iraq policy, which is supported only by the UK, which is a North Sea oil producer itself.

All of these present problems and developments now threaten, according to Frank, to pull the rug out from under US domestic and international political economy and finance. The only protection still available to the United States still derives from its long since and still only two pillars of the NEW WORLD ORDER established by President Bush father after Bush's Gulf War" against Iraq and the dissolution of the Soviet Union in 1991. President Bush son is now trying to consolidate his father's new world order beginning with the WAR AGAINST AFGHANISTAN, and the Bush-Putin effort now also to construct a US-Russian Entente - or is it Axis.

The dollar pillar is now threatening to crumble, as it already did after the Vietnam War but has so far remained standing through three decades of remedial patchwork. But as we have seen, the US is now running out of further economic remedies to maintain the dollar pillar upright. It's only protection would be to generate serious inflation in the short run by printing still more US dollars to service its debt, which would then undermine its strength and crack the dollar pillar and weaken the support it affords still more.

That would leave, Frank says, only the US military pillar to support US political economy and society. But it and reliance on it also entails dangers of its own. Visibly, that is the case for such as Iraq, Yugoslavia, and Afghanistan and of course all others who are thereby deliberately put on notice to play ball by US rules in its new world order on pain of eliciting the same fate for themselves. But the political blackmail to participate in the new world order on US terms also extends to US - especially NATO - allies and Japan. It was so exercised in the Gulf War [other states paid US expenses so that the US made a net profit from that war], the US war against Yugoslavia in which NATO and its member states were cajoled to participate, and then, Frank argues, by the War against Afghanistan as part of President Bush's new policy pronouncement. He used the early Cold WAR terminology of John Foster Dulles that ‘‘you Are either with us or against us". But US reliance on this, the then only remaining, strategy of military political blackmail can also lead the US to bankruptcy as the failing dollar pillar fails to support it as well; and it can come also to entail US OVERSTRETCH in Paul Kennedy terms and BLOWBACK in CIA terms.

Etiquetas: Propuestas y recomendaciones